Monday, August 10 – Austin Metro Real Estate Update

335 new homes emerged on the market in the past 7 days. 22% decrease from last week.

460 homes went under contract in the past 7 days. 25% decrease from last week.

280 homes sold and closed in the past 7 days. 50% decrease from last week.

73 homes withdrawn or temporarily taken off the market. 3% decrease from last week.

Austin Metro Area Market Overview from Agent Jill

We saw a noticeable cool down in active, pending, and sold properties in the Metro last week. This shift is much more typical of a later summer Austin market than we have been seeing. Low interest rates are still keeping buyer traffic steady and strong with potential homeowners not wanting to lose out on the opportunity to purchase during these historically low interest rates. The challenge we face now in our area is how do we provide housing supply for this high level of demand as we see home inventory decrease. That is the “million dollar” questions for the Austin metro moving forward especially now that we face the news of yet another major employer, Tesla, coming to town.

IMPORTANT UPDATES ON – Interest Rates, Loan Refinancing & Loan Qualification

Our lenders have been talking about mortgage rates possibly going lower yet this year and low and behold today’s news reflected that prediction!

Right now you can get 2.5% for a conventional loan. 2.5% everyone! This is HISTORIC!!! Now I want to reiterate that consumers are not quite seeing these kinds of rates for home mortgage refinances. The reality is that demand is so high for refinances right now the only way to lessen the demand and help unclog the system is to discourage through higher rates. So, Please shop around and be patient if you are looking to refinance.

Remember that mortgage qualification rules have changed during covid so if you know you are needing to shop for a home mortgage provider in the next 6-12 months set aside time to let our lenders educate you on the scene. A consultation with one of our local lenders can help you identify how to navigate the new financial options for a home purchase so you can plan accordingly.

As always our preferred lenders are available to discuss changes in the mortgage scene and answer your questions.

A Look Ahead at the Economy – What’s on the Horizon? Will 2020/2021 be Better? Same? or Worse

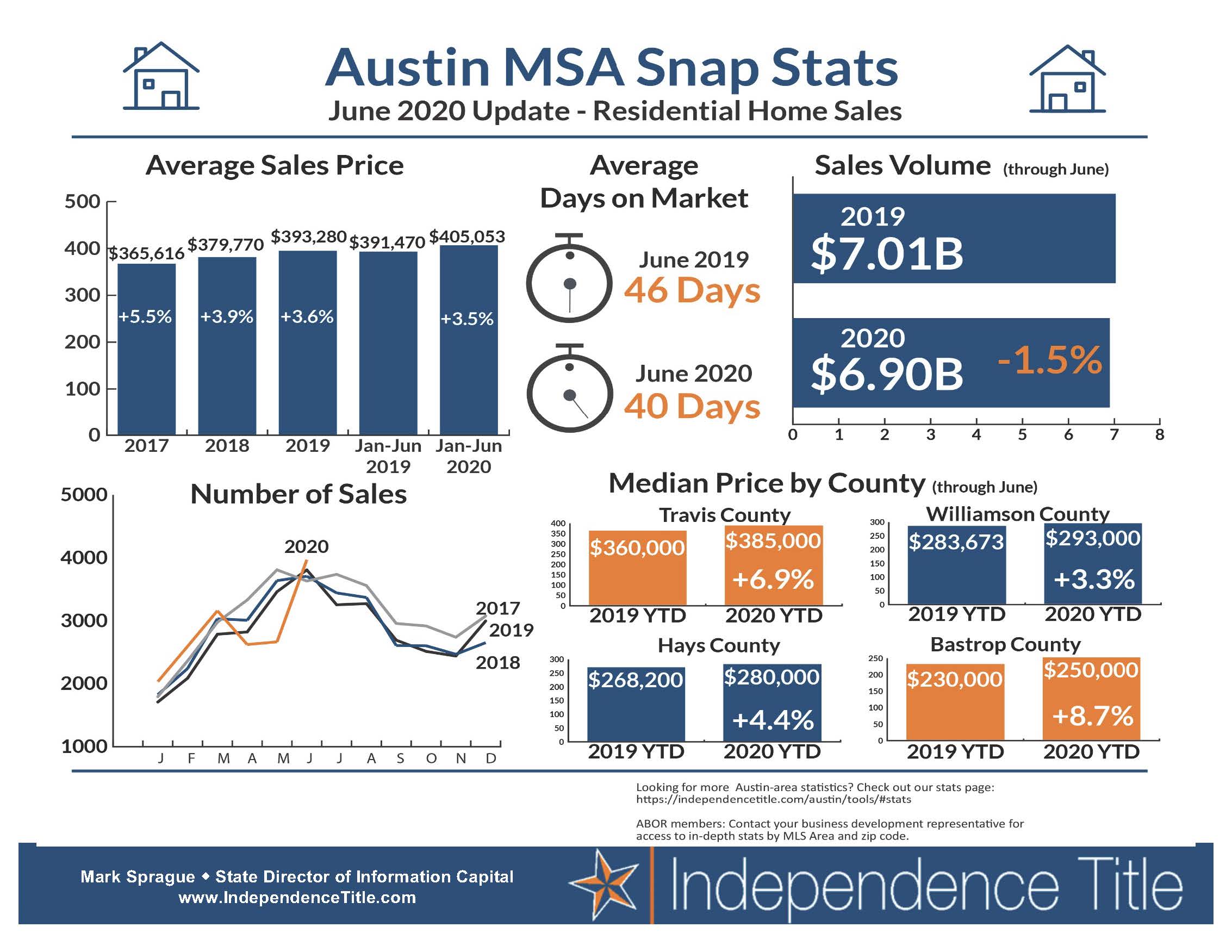

Highlights from Mark Sprague’s economic presentation

I had the pleasure of attending another webinar last week by local real estate analyst Mark Sprague. Mark shared his thoughts and updates on where the economy is across the country as well as here in Texas and Austin.

I had the pleasure of attending another webinar last week by local real estate analyst Mark Sprague. Mark shared his thoughts and updates on where the economy is across the country as well as here in Texas and Austin.

Key takeaways from his presentation 1. Austin markets and submarkets continue to outperform the region and nation. 2. Once this crisis passes, Austin is prepared for the market to start strong, on multiple fronts, 3. Austin’s growth can not be sustained without more inventory. I encourage anyone who really enjoys digging into the conversation and data on the economic impacts of this pandemic to read through Mark’s presentation.

Agent Jill Summer Projects Journal

I attended a great seminar a few weeks ago that has sparked my desire to explore the great classic writers. I’ve talked about how this pandemic has freed up time for me to read and now I am tackling the Syntopicons Great Conversations collection. Think my farm friends will enjoy hearing some Sophocles, Plato, and Aristotle during their weekly feedings? I’ll let you know how it goes!

I attended a great seminar a few weeks ago that has sparked my desire to explore the great classic writers. I’ve talked about how this pandemic has freed up time for me to read and now I am tackling the Syntopicons Great Conversations collection. Think my farm friends will enjoy hearing some Sophocles, Plato, and Aristotle during their weekly feedings? I’ll let you know how it goes!